A temporary account is an income statement account, dividend account or drawings account. It is temporary because it lasts only for the accounting period. At the end of the accounting period, the balance is transferred to the retained earnings account, and the account is closed with a zero balance. For each temporary account there will be a closing journal entry. Temporary (nominal) accounts are accounts that are closed at the end of each accounting period, and include income statement, dividends, and income summary accounts. These accounts are temporary because they keep their balances during the current accounting period and are set back to zero when the period ends.

Part 2: Your Current Nest Egg

- What is the current book value ofyour electronics, car, and furniture?

- The post-closing T-accounts will be transferred to thepost-closing trial balance, which is step 9 in the accountingcycle.

- This crucial step ensures that financial records are accurate and up-to-date for the next period, making it easier to track the company’s performance over time.

- As the drawings account is a contra equity account and not an expense account, it is closed to the capital account and not the income summary or retained earnings account.

- Well, dividends are not part of the income statement because they are not considered an operating expense.

- The main change from an adjusted trial balance is revenues, expenses, and dividends are all zero and their balances have been rolled into retained earnings.

It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process. The net income (NI) is moved into retained earnings https://www.bookstime.com/ on the balance sheet as part of the closing entry process. The assumption is that all income from the company in one year is held for future use. One such expense that’s determined at the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors. Temporary accounts are used to record accounting activity during a specific period.

What Is an Accounting Period?

Afterwards, withdrawal or dividend accounts are also closed to the capital account. This is closed by doing the opposite – debit the capital account assets = liabilities + equity (decreasing the capital balance) and credit Income Summary. Now for this step, we need to get the balance of the Income Summary account.

Temporary vs Permanent Accounts

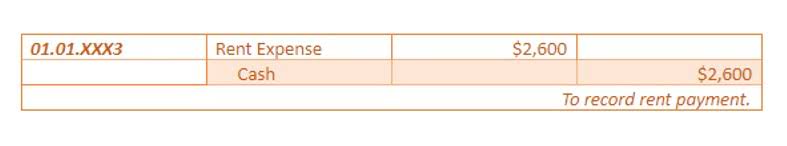

You see that you earned $120,000 this year in revenueand had expenses for rent, electricity, cable, internet, gas, andfood that totaled $70,000. To close the drawing account to the capital account, we credit the drawing account and debit the capital account. Closing entries are an important facet of keeping your business’s books and records in order. By maintaining your bookkeeping, you can ensure that you are constantly kept informed. As well as being consistently up-to-date on the financial health of your business. The T-account summary for Printing Plus after closing entries are journalized is presented in Figure 5.7.

Prepare the closing entries for Frasker Corp. using the adjustedtrial balance provided. Notice that the Income Summary account is now zero and is readyfor use in the next period. The Retained Earnings account balanceis currently a credit of $4,665. Printing Plus has a $4,665 credit balance closing entries in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings. It is the end of the year,December 31, 2018, and you are reviewing your financials for theentire year.

- The closing entries are the journal entry form of the Statement of Retained Earnings.

- The IncomeSummary account has a new credit balance of $4,665, which is thedifference between revenues and expenses (Figure5.5).

- And unless you’re extremely knowledgeable in how the accounting cycle works, it’s likely you’ll make a few accounting errors along the way.

- The second entry requires expense accounts close to the Income Summary account.

- However, the cash balances, as well as the other balance sheet accounts, are carried over from the end of a current period to the beginning of the next period.

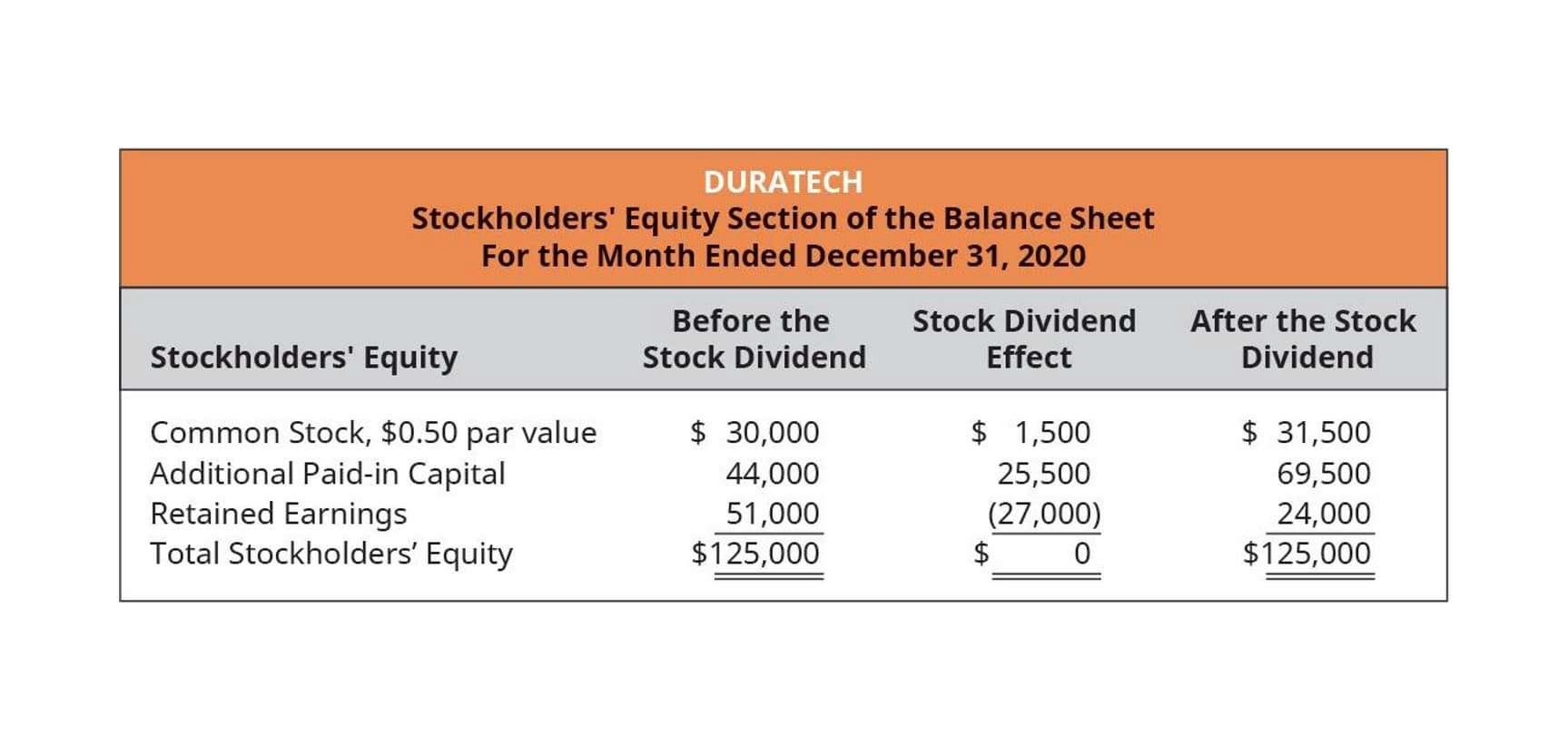

These accounts carry their ending balances into the next accounting period and are not reset to zero. Since dividend and withdrawal accounts are not income statement accounts, they do not typically use the income summary account. These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings. The four closing entries are, generally speaking, revenue accounts to income summary, expense accounts to income summary, income summary to retained earnings, and dividend accounts to retained earnings.