Content

It is also known as profit and loss account and is prepared to provide information on an agency’s profitability over a given time period. It is the statement of the revenues earned and other gains made during a year; matched with the amounts spend to earn these revenues. In 1979, Touche Ross and Co., developed the ASTA Travel Agency Accounting System to facilitate travel agent and tour operators specifically for ARC and IATA reporting.

We focus on providing 100% accurate accounting, GST & VAT accounting, integration with online ticketing portals. Your agency’s financial health is key to the survival of your business; analyzing and controlling your finances leads to strong business plans and better strategic decisions. Learn to speak accounting language, grasp accounting principles and interpret financial statements to assess and steer your business. This step-by-step, interactive online course walks you through practical accounting and finance procedures and proven strategies for profitability.

Sign in for the full experience.

A trustworthy accounting software tailored to the software industry has to be fully interfaced to a GDS like Sabre or Amadeus or booking engines. Reservations made in one of these booking tools activate the automatic generation of the invoice in the accounting software and this, without any manual intervention or double data entry with all the related risks of error. Accounting software for travel agencies has to connect all the parameters set as a rule. It is necessary to be able to visualize in a file’s history all the accounting implications. In addition, travel agencies should maintain detailed records for commissions and future revenue.

Budgeting is the process of forecasting future expenses and revenue, creating a financial plan to meet these goals. Good accounting practices are crucial for any business, including travel agencies. Effective accounting helps travel agencies monitor their financial performance, track expenses and revenue, manage cash flow, and make informed decisions. Accurate accounting also ensures compliance with tax laws and other regulations.

000+ Travel Agency Accounting Jobs in United States

Travel Accounting System is a feature-packed, simple to use accounting software that will reduce your data entry work and help you enhance productivity exponentially. Accounting software carries the guarantee of quality service and quality accounting for your travel and tour business to handle your finance with ease. As a travel agency owner, you need to remember that you are running a business, making it essential to have separation of business and personal items. If your business were to be sued, the courts might come after your personal assets if they see the comingling of business and personal expenses.

An income statement contains a summary of figures relating to the cost of tours sold; various operating and non-operating expenses and provisions for expenses. These are then compared with sales and various operating and non-operating revenues. It is the monetary value of goods and services sold by the travel agency such as the sale of the tour, airlines commission and interest received etc.

Accounting App for Travel Agencies That Offers Secure Online Payments

Other new contracts, including renewals or extensions, would not be awarded. Payments to defense contractors such as Boeing (BA.N), Lockheed Martin (LMT.N) and RTX (RTX.N), formerly known as Raytheon, could be delayed. Instead, agencies can excuse excepted employees from duty and place them in furlough status for the time they are out. And an excepted travel agency accounting employee who had been scheduled to be on paid leave may be off duty for those periods. If a customer asks you how much they owe on their upcoming trip, can you easily tell them? By having a detailed record system, you can easily pull up their receivable balance, creating a positive customer experience and ensuring you are undercutting your revenue.

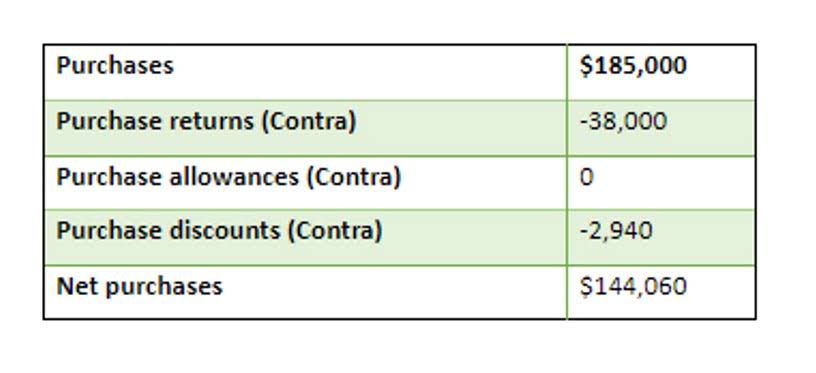

Today, these statements are considered as a base for making rational decisions concerning the future of the travel agency. Basically, these are cash outflows and are paid by the agency to obtain or purchases goods and services from the providers. Other expenses are included in it like as salary, administrative expenses, financial and legal expenses etc. The procedure of posting IATA Ledger is very simple and easy to understand. Today, almost every travel agency is using Electronic Data Processing System (EDP) to maintain an up-to-date record of each cash as well as credit card transactions. We will help to grow your business and solve the challenges in your journey.

Travel agency accounting is a crucial aspect that a travel agency needs to take care of at all times, irrespective of its scale and geography of operation. The availability of travel management platforms like Pathfndr and their integration of automated accounting tools amps up the overall financial management of the company. The total cost that a travel agency incurs, including the cost in the long as well as short term, for running the business can be accounted for under the expenses head of the travel agency accounting system. Expenditures are also identified as the sum of cash outflow made by the agency in return of services or products received towards the entity’s operation in short as well as long run.